.jpg)

Are We Headed for Another Financial Crisis?

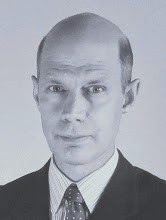

Robert J. Shiller

Economist and Nobel Laureate

Foreign Correspondents' Club of Japan

11:00~12:00

------------------------------------------------------

11:06 Shiller presentation: Of course there is going to be a crisis, the history of the last 800 years is a cascade of crises.

11:08 My view is that financial crisis is a crisis of human emotions, the loss of confidence, a psychological effect.

11:09 In 2005, the new edition of Irrational Exhuberrence focused on the housing market, rather than the stock market (first edition focus)

11:10 The weakness/source of concern now is bond markets, where prices of bonds seem way out of line.

11:11 So talk today is about stock markets, housing markets and then some observations of world bond markets, where the yields are startingly low.

11:15 Cyclically adjusted price earnings (CAPE) in U.S. markets are at their third highest marks in history, second only to the 2000 millenium boom and the 1929 Roaring Twenties.

11:16 Japanese CAPE ratios were astronomical in the EARLY 1980s but now shrunk to global norms.

11:18 Japanese confidence in rising share prices remains aberrantly positive.

11:20 U.S. economy is now in deflation.

11:21 Trend in yields in U.S. bonds in relentless downward, and downward at an almost constant rate for the last 30 years.

11:24 Psychologically, loss of confidence, less of a sense of security, from 1) capitalist ideology (everyone for himself/herself)

11:22 Trends in bond yield declines are a global phenomenon, somewhat irrespective of the particular actions of central banks.

11:24 2) computer technology,

11:25 The result is excess savings and the bidding up of the prices of existing businesses and governments. The lack of security is thus leading people to cut back spending and/or starting their own businesses.

11:27 Entrepreneurial and development successes are receding, leading to weakness in confidence that is often called secular stagnation.

11:29 Q: How much can politics can change economic psychology? (Abe reference)

11:31 The "Three Arrows" are actually concrete proposals, not an attempt to talk up the economy. That is what makes the proposals worthwhile, as just cheerleading has a poor record of success.

11:33 Shiller - NASDAQ high yesterday, adjusted by CPI inflation, is not at historic highs. So not so significant.

11:34 Japanese confidence bled into world markets, distorting international flows toward Japan, in the same way that overconfidence in tech magic led to NASDAQ historic highs.

11:37 Shiller - I had a conversation with Prime Minister Abe a year ago - unfortunately I (Shiller) did most of the talking so I have little so say about Mr. Abe's thinking about Abenomics.

11:38 (Says an interesting thing about labor force security - MTC here). Shiller sees the easier firing of Japanese workers as a good thing for efficiency. Intriguing...really?

11:42 In the U.S., there is a socialist economy in the housing markets.

11:44 Schiller - Decision to create the euro was politically an act of genius and not an act of genius economically. Euro is important as a symbolic act, but one with too many economic consequences. Symbolism is good.

11:47 Income inequality - Piketty, capital accummulation; Shiller, technological inequality.

11:48 Shiller quotes Norbert Wiener on whether the nuclear weapon or the computer is more dangerous. Worries about robots replacing human labor.

11:50 Abe advisor and fellow Yale economics professor Hamada Koichi is offering commentary on the presentation.

.jpg)

Hamada Koichi

FCCJ press conference of Robert Shiller on 3 March 2015

--------------------------------------------

11:51 Hamada: "There is a rosy future for the Japanese economy."

11:52 Hamada: "Mr. Abe is holding back, allowing the figures to speak."

"Oil prices are a positive. A million workers have entered the labor force. Wage are increasing. But Abe must do reforms, overcoming obstacles."

11:54 Hamada+Shiller - Womenomics is important. Shiller: it is inspiring. Hamada: numbers are returning (???) to the job market.

[Nota bene: the % of women in the Japanese workforce is higher than the participation rate for U.S. women - MTC)

11:57 Q: with true declines in populations and aging of populations, is not there no exit out of slowing or contracting economies?

Shiller: government policy to combine career and family is an important step to reversing or slowing decay in confidence.

11:59 If you want to end inequality, you should have career insurance -- takes care of the insecurity of life planning. Governments must have a plan to tax the wealthy and subsidize work, do it now for the future rather than try to deal with inequality (worsening?) in 20 year's time.

No comments:

Post a Comment